Today, technology has empowered borrowers to select the best loan providers that fit their needs, goals, and financial condition. Similarly, technology has empowered financial institutions such as banks to efficiently address the specific loan requirements of potential borrowers in accordance with their financial qualification and specified reason behind applying for a loan.

Lending management solutions (LMS) have turned into a must-have in today's financial landscape. With automation, these solutions are tackling the challenges of voluminous manual data entries and records that require significant time, cost, and workforce alongside being a source of error. Digitization of the entire lending process is taking care of NBFC functions, ledgers (general, share personal, loan personal, and more), balance sheets, loan's demand generation, reports for receipts, payments, profit/loss, and so on. While the amount of loan associated data such as banking transaction history is increasing, LMS helps both bankers and the borrowers customize and streamline the process of lending, facilitating cost reduction and faster loan approval.

LMS enable faster end-to-end loan application process which is considered the most significant differentiator in auto loan financing. These solutions offer end-to-end lending management functionality for different types of loans, configurable credit monitoring activity, alert management, omnichannel settlement of account, bank-oriented rephasement and reschedule activity, and much more. They also ensure compliance with the strict banking policies regulating the industry helping avoid lending risks. Emerging LMS aim to understand today's borrowers, keeping things swift and simple with cross-selling works and a focus on reaching younger borrowers.

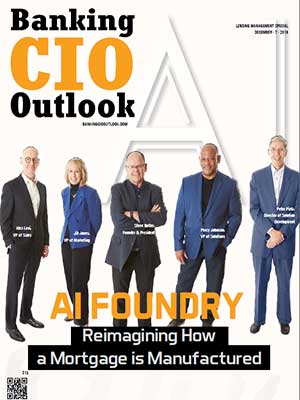

A distinguished selection panel comprising CEOs, CIOs, VCs, and the magazine’s editorial board has selected a list of the top lending management solution providers that leverage innovative technologies and strategies to enhance today’s lending management solutions for the benefit of financial institutions such as banks as well as borrowers. This edition of Banking CIO Outlook features companies with expertise in lending management measures and technologies to update you about the lending management solutions you can choose from to grow revenues with enhanced customer experience, attract new loan applicants, earn stronger customer loyalty, avoid risk, and boost lifetime values.

We present to you Banking CIO Outlook’s "Top 10 Lending Management Solution Providers - 2018."

![OnDeck Capital [NYSE:ONDK] - Top Lending Management Solution Companies OnDeck Capital [NYSE:ONDK]](https://www.bankingciooutlookeurope.com/company_logos/y9zvhonlogo.jpg)